Who is a Business Associate?

A “Business Associate” refers to an individual or entity that performs certain functions or activities involving the use or disclosure of protected health information (PHI) on behalf of, or provides services to, a covered entity in the healthcare sector. This term is commonly used in the context of the Health Insurance Portability and Accountability Act (HIPAA) in the United States. Business associates might include consultants, billing companies, IT service providers, attorneys, and other third-party service providers who have access to PHI through their work with healthcare organizations.

Examples of Business Associates

Examples of Business Associates include:

Healthcare Billing Services: Companies that handle billing for hospitals, clinics, or individual practitioners. They process health information when managing claims and payments.

IT Service Providers: Firms that manage or support IT infrastructure for a healthcare provider, including those that store or have access to electronic protected health information (ePHI).

Healthcare Consultants: Professionals who advise healthcare entities on various operational, financial, or administrative matters and have access to PHI in the process.

Legal Professionals: Attorneys who provide legal services to healthcare entities and may need to access PHI for cases or compliance issues.

Shredding and Document Destruction Companies: Entities that dispose of physical records containing PHI for healthcare organizations.

Medical Transcription Services: Companies that transcribe physician notes, surgical reports, and other voice-recorded medical reports into written text.

Pharmacy Benefit Managers: Firms that manage prescription drug programs for health plans, which involves handling PHI.

Answering Services for Healthcare Providers: Companies that provide after-hours answering services for healthcare providers and may have access to PHI during their communications.

Data Analysis Firms: Organizations that analyze healthcare data for various purposes, including research, policy development, and quality assurance.

Cloud Storage Providers: Companies offering cloud storage solutions where healthcare entities might store ePHI.

BUSINESS ASSOCIATES AND BAAS

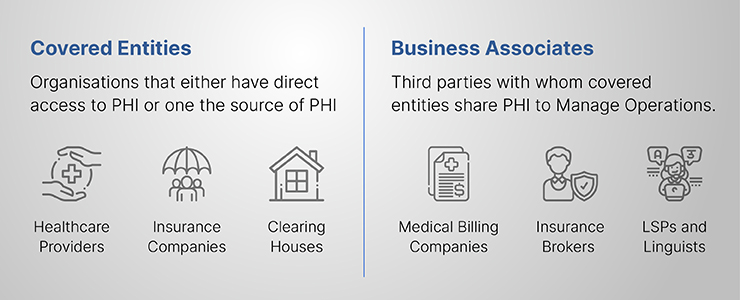

Business Associates and BAAs” refers to the relationship between healthcare entities (covered entities) and their business associates under the Health Insurance Portability and Accountability Act (HIPAA) in the United States. A Business Associate Agreement (BAA) is a critical component of this relationship.

Business Associates: These are individuals or entities that perform activities or functions involving the use or disclosure of protected health information (PHI) on behalf of, or provide services to, a covered entity. Examples include IT service providers, billing companies, consultants, lawyers, and third-party administrators.

Business Associate Agreements (BAAs): These are legally binding contracts that establish the permissible and required uses and disclosures of PHI by business associates. BAAs ensure that business associates comply with applicable HIPAA rules and safeguard PHI. They outline responsibilities regarding the handling of PHI, reporting of breaches, and ensuring the privacy and security of health information.

What is a HIPAA Business Associate Agreement?

A HIPAA Business Associate Agreement (BAA) is a legal document required under the Health Insurance Portability and Accountability Act (HIPAA) in the United States. It establishes the responsibilities of a business associate when handling protected health information (PHI) on behalf of a covered entity, such as a healthcare provider, health plan, or healthcare clearinghouse.

Key elements of a HIPAA Business Associate Agreement include:

Use and Disclosure of PHI: The BAA specifies how the business associate can use and disclose PHI. It must align with the privacy and security requirements of HIPAA.

Safeguards for PHI: The agreement requires the business associate to implement appropriate safeguards to prevent unauthorized use or disclosure of PHI, including administrative, physical, and technical safeguards.

Reporting of Breaches: The BAA mandates that the business associate report any unauthorized use or disclosure of PHI, including breaches of unsecured PHI, to the covered entity.

Subcontractors and Agents: It requires the business associate to ensure that any subcontractors or agents that handle PHI on their behalf also comply with HIPAA regulations.

Compliance with the HIPAA Security Rule: For electronic PHI (ePHI), the business associate must comply with the HIPAA Security Rule’s requirements to protect the information’s confidentiality, integrity, and availability.

Termination Rights: The agreement outlines the conditions under which the contract can be terminated if the business associate violates its terms.

Return or Destruction of PHI: Upon termination of the agreement, the BAA often requires the business associate to return or securely destroy all PHI received from, or created or received on behalf of, the covered entity.

WHAT HAPPENS WHEN BUSINESS ASSOCIATES VIOLATE HIPAA REGULATIONS?

When a business associate violates HIPAA (Health Insurance Portability and Accountability Act) regulations, several consequences can ensue, impacting both the business associate and the covered entity they work with:

Investigation and Enforcement: The U.S. Department of Health and Human Services (HHS), particularly the Office for Civil Rights (OCR), investigates complaints or breaches involving the violation of HIPAA rules. This investigation can lead to various enforcement actions.

Financial Penalties: Business associates can face significant financial penalties for HIPAA violations. These fines vary based on the severity and nature of the violation and can range from a minimum of $100 per violation to upwards of $50,000 per violation, with annual maximums that can reach into the millions of dollars.

Corrective Action Plans: In some cases, the OCR may require the business associate to implement a corrective action plan to address and remedy the compliance issues. This often involves revising policies and procedures, improving data security measures, and conducting additional staff training.

Legal Liability: Business associates may face civil lawsuits from individuals harmed by the breach or violation. These lawsuits can lead to additional financial liabilities and reputational damage.

Criminal Charges: In cases of severe violations, such as intentional theft or sale of PHI, criminal charges can be filed against the individuals responsible.

Termination of Business Relationships: The covered entity may terminate its contract with the business associate. This can lead to loss of business and reputation, which can be damaging especially for those whose primary clients are covered entities.

Reputational Damage: HIPAA violations can lead to public reporting of the breach or violation, resulting in reputational harm and loss of trust among current and potential clients.

Notification Requirements: The business associate may be required to notify affected individuals, the covered entity, HHS, and, in some cases, the media, depending on the size and scope of the breach.

Increased Oversight: Following a violation, business associates might be subjected to more rigorous audits and compliance checks by regulators and covered entities.

What happens if the BAA or BAAS fails to secure the patient’s information?

When a business associate violates HIPAA (Health Insurance Portability and Accountability Act) regulations, several consequences can ensue, impacting both the business associate and the covered entity they work with:

Investigation and Enforcement: The U.S. Department of Health and Human Services (HHS), particularly the Office for Civil Rights (OCR), investigates complaints or breaches involving the violation of HIPAA rules. This investigation can lead to various enforcement actions.

Financial Penalties: Business associates can face significant financial penalties for HIPAA violations. These fines vary based on the severity and nature of the violation and can range from a minimum of $100 per violation to upwards of $50,000 per violation, with annual maximums that can reach into the millions of dollars.

Corrective Action Plans: In some cases, the OCR may require the business associate to implement a corrective action plan to address and remedy the compliance issues. This often involves revising policies and procedures, improving data security measures, and conducting additional staff training.

Legal Liability: Business associates may face civil lawsuits from individuals harmed by the breach or violation. These lawsuits can lead to additional financial liabilities and reputational damage.

Criminal Charges: In cases of severe violations, such as intentional theft or sale of PHI, criminal charges can be filed against the individuals responsible.

Termination of Business Relationships: The covered entity may terminate its contract with the business associate. This can lead to loss of business and reputation, which can be damaging especially for those whose primary clients are covered entities.

Reputational Damage: HIPAA violations can lead to public reporting of the breach or violation, resulting in reputational harm and loss of trust among current and potential clients.

Notification Requirements: The business associate may be required to notify affected individuals, the covered entity, HHS, and, in some cases, the media, depending on the size and scope of the breach.

Increased Oversight: Following a violation, business associates might be subjected to more rigorous audits and compliance checks by regulators and covered entities.

REVIEWING THE BUSINESS ASSOCIATE RELATIONSHIP, ENGAGING WITH THIRD-PARTY VENDORS

Reviewing the business associate relationship and engaging with third-party vendors in the context of HIPAA compliance involves several critical steps. This process ensures that the handling of protected health information (PHI) adheres to the required standards of privacy and security. Here’s an outline of the key considerations:

Assessment of Needs and Risks: Before engaging a third-party vendor, it’s essential to assess the specific services needed and the associated risks, especially concerning the handling of PHI.

Selecting Appropriate Vendors: When choosing third-party vendors, it’s crucial to select those that have experience with HIPAA compliance and are willing to enter into a Business Associate Agreement (BAA).

Executing a Business Associate Agreement (BAA): A BAA is a mandatory contract that outlines the responsibilities of the business associate regarding the handling, protection, and breach notification of PHI. It ensures both parties understand their compliance obligations under HIPAA.

Conducting Due Diligence: Regularly evaluate the business associate’s compliance with HIPAA. This might involve reviewing their security policies, procedures, and past performance regarding PHI protection.

Training and Awareness: Ensure that the staff of both the covered entity and the business associate are adequately trained on HIPAA requirements and the specifics of the BAA.

Monitoring and Auditing: Implement ongoing monitoring and auditing processes to ensure the business associate adheres to HIPAA regulations and the terms of the BAA.

Incident Management and Reporting: Establish clear procedures for incident management, including the reporting and investigation of any potential HIPAA violations or breaches of PHI.

Review and Update BAAs: Regularly review and update BAAs to reflect changes in business practices, HIPAA regulations, or other relevant laws.

Termination Procedures: Define clear termination procedures in the BAA, including the return or destruction of PHI when the business relationship ends.

Managing Subcontractors: Ensure that the business associate is managing its subcontractors appropriately, including obtaining BAAs with them if they will have access to PHI.

Communication and Collaboration: Maintain open lines of communication with the business associate for any issues related to PHI handling, compliance updates, or changes in business operations.

FAQ

Are Business Associates Exempt from HIPAA?

No, business associates are not exempt from HIPAA. Under the HIPAA regulations, business associates are directly liable for compliance with certain requirements of the HIPAA Privacy and Security Rules. This includes the unauthorized use and disclosure of protected health information (PHI), implementing safeguards to protect the confidentiality, integrity, and availability of electronic PHI, and reporting breaches of PHI.

Who Needs to Sign the Business Associate Agreement?

The Business Associate Agreement (BAA) must be signed by both the covered entity and the business associate. A covered entity is typically a healthcare provider, health plan, or healthcare clearinghouse. A business associate is an individual or entity that performs activities or functions involving the use or disclosure of PHI on behalf of, or provides services to, the covered entity.

Can PHI be Disclosed by a Business Associate?

Yes, a business associate can disclose PHI, but only as permitted or required by their Business Associate Agreement or as required by law. The BAA should clearly outline the circumstances under which PHI can be used or disclosed. Any use or disclosure of PHI by a business associate that falls outside the scope of the BAA or the HIPAA regulations can lead to significant legal and financial penalties.

What are Business Associates Not Permitted to Do?

Business associates are not permitted to:

- Use or disclose PHI in ways that are not authorized by their BAA or required by law.

- Fail to use appropriate safeguards to prevent unauthorized use or disclosure of PHI, including implementing necessary physical, administrative, and technical safeguards.

- Fail to report breaches of PHI to the covered entity in a timely manner.

- Block or terminate access by an individual to their own PHI.

- Use or disclose PHI in a manner that would violate the HIPAA Privacy Rule if done by the covered entity, except for certain specific provisions that allow for more flexibility in the case of business associates.

- Fail to provide the HHS Secretary with records and compliance reports, cooperate with complaint investigations and compliance reviews.